Data Interpretation

1. Step 1 - Put the 3 countries into a ratio

Austria (Quarter 4) : Portugal (Quarter 1): Greek (Quarter 4)

= 35,000: 28,000: 21,000

Step 2 simplify the ratio (recognize that 7 is a common denominator)

5:4:3

Thus the correct answer is (D), 5:4:3

2. Tip: Notice that all the available answers have just one country, so we know

that as soon as we have found one country that exceeded its target, we have the

correct answer and we can move on.

Step 1 Calculate the total unit sales for each country

Greece = 108,300

Portugal = 104,200

Austria = 105,800

Ireland = 102,400

Crotia = 105,200

Step 2 Compare each total to the Yearly Target (Unit sales)

Targets are either 105,000 or 110,000.

Only Austria has exceeded its 105,000 target.

Thus the correct answer is (C), Austria

3. Step 1 calculate this years average number of Portuguese units sold per

quarter

(28,000 + 33,200 + 22,600 + 20,400) / 4 = 104,200 /4 = 26,050

Step 2 calculate a 20% increase to get last years average number of

Portuguese units

sold per quarter

26,050 x 1.2 = 31,260

Thus the correct answer is (B), 31,260

4. Step 1 Calculate the Total value of Austrian unit sales

Total Austrian unit sales = 105,800

Total value of Austrian unit sales = 105,800 x 3.5 = 370,300

Step 2 - Calculate the corporation tax for the first 200,000 of Austrian unit sales

200,000 x 22% = 44,000

Step 3 - Calculate the tax for sales exceeding 200,000

370,300 - 200,000 = 170,300

170,300 x 20% = 34,060

Step 4 calculate the total tax

44,000 + 34,060

Thus the correct answer is (D), 78,060

5. Step 1 Calculate the Total value of Austrian unit sales

Total Austrian unit sales = 105,800

Total value of Austrian unit sales = 105,800 x 3.5 = 370,300

Step 2 - Calculate the corporation tax for the first 200,000 of Austrian unit sales

200,000 x 22% = 44,000

Step 3 - Calculate the tax for sales exceeding 200,000

370,300 - 200,000 = 170,300

170,300 x 20% = 34,060

Step 4 calculate the total tax

44,000 + 34,060

Thus the correct answer is (D), 78,060

6.

7.

Thus the correct answer is (D), Competitor E

8. The information that you need is shown in the graph.

Step 1 Calculate the total operating profits for Competitors B to E

45.4 + 56.5 + 42.9 + 42.7 = £187.5 million

Step 2 Calculate operating profits for the entire sector

187.5 χ 0.85 = 220.6 million.

Step 3 Calculate other companies operating profits

220.6 x 15% = 33.09 million = £33 million approx.

Thus the correct answer is (C), £33 million

9. The information that you need is shown in the graph.

Step 1 Calculate the additional sales for Competitor B

52.5 x 8% = 4.20

Step 2 Calculate the additional sales for Competitor A

57.4 x 7% = 4.02

Step 3 Calculate the additional sales for Competitor C

68.2 x 4% = 2.73

Step 4 Calculate the total sales

4.20 + 4.02 + 2.73 = 10.95

Step 5 to the nearest £million

10.95 = £11 million

Thus the correct answer is (C), £11 million

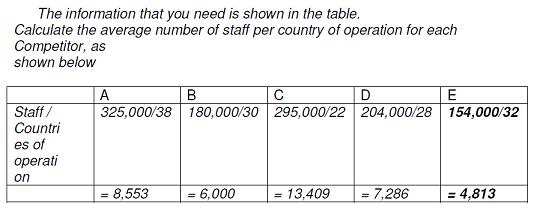

10. The information that you need is shown in the table.

Calculate the average number of customers per country of operation for each

Competitor

Competitor A = 4.2/38 = 0.111

Competitor B = 2.2/30 = 0.073

Competitor C = 4.5/22 = 0.205

Competitor D = 3.1/28 = 0.111

Competitor E = 2.4/32 = 0.080

Thus the correct answer is (A), Competitor A and Competitor D

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 |

| 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 |

| 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | 73 | 74 | 75 | 76 | 77 | 78 | 79 | 80 |

| 81 | 82 | 83 | 84 | 85 | 86 | 87 | 88 | 89 | 90 | 91 | 92 | 93 | 94 | 95 | 96 | 97 | 98 | 99 | 100 |

| 101 | 102 | 103 | 104 | 105 | 106 | 107 | 108 | 109 | 110 | 111 | 112 | 113 | 114 | 115 | 116 | 117 | 118 | 119 | 120 |

| 121 | 122 | 123 | 124 | 125 | 126 | 127 | 128 | 129 | 130 | 131 | 132 | 133 | 134 | 135 | 136 | 137 | 138 | 139 | 140 |

| 141 | 142 | 143 | 144 | 145 | 146 | 147 | 148 | 149 | 150 | 151 | 152 | 153 | 154 | 155 |

Passage Reading

Passage Reading

Verbal Logic

Verbal Logic

Non Verbal Logic

Non Verbal Logic

Numerical Logic

Numerical Logic

Data Interpretation

Data Interpretation

Reasoning

Reasoning

Analytical Ability

Analytical Ability

Basic Numeracy

Basic Numeracy

About Us

About Us

Contact

Contact

Privacy Policy

Privacy Policy

Major Tests

Major Tests

FAQ

FAQ